Like many cryptocurrencies, Ethereum has been growing in value since last year. But not without a considerable amount of volatility, price corrections, and speculations. At press time, the token was trading around the $3,820 mark, with a 4.5% setback.

Well for some it might induce fear but for long term / prominent investors it points to a ‘buy down’ scenario.

Shopping spree

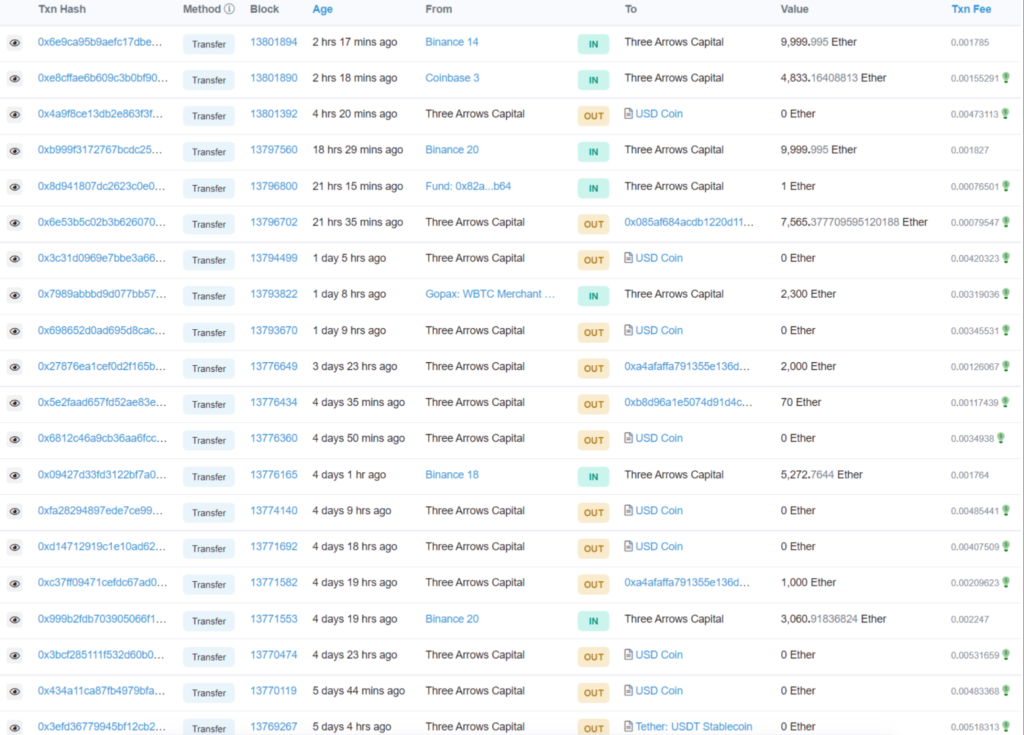

Crypto hedge fund Three Arrows Capital (3AC) founded in 2012 by Su Zhu and Kyle Davies, reportedly received $56 million worth of Ether earlier today. According to Etherscan, it transferred a total of 14,833 ETH (approximately $56M) from Binance and Coinbase to its wallet.

Consider the table below:

Wu Blockchain, a Chinese crypto reporter further tweeted:

“Since the transfer of 91,477 ETH from the exchange on December 7, Three Arrow Capital has frequently interacted with the exchange, and a total of 22,416 ETH has been transferred from the exchange in the past week.”

However, this was not the first time that said company has purchased ETH despite a raffle as mentioned above. At the start of the week, the company received $ 400 million of ether during the weekend. 97,477 ETH moved from FTX, Binance and Coinbase cryptocurrency exchanges to a wallet marked by Nansen as owned by Three Arrows Capital.

Surprisingly, Zhu of Three Arrows responded to the tweet by saying that “100k eth is dust,” and that there’s “more coming.” This shows his bullish mentality concerning the altcoin.

The portfolio shows that 3AC made the majority of its purchases during the weekend’s price drop.

Smells ‘fishy’

It certainly does as was highlighted by different users on the same thread. Consider this: in an anti-ETH tirade between Nov. 20 and Nov. 22, Zhu Su tweeted about why he had “abandoned Ethereum despite supporting it in the past.”

During the tweeting storm, Zhu claimed that the Ethereum culture “was suffering massively from the founders’ dilemma” and that “everyone is already far too rich to remember what they originally planned to do.”

However, after attracting wide attention, he made a U-turn, saying he wanted to “soften” his original stance and “I love Ethereum and what it stands for.”

What does that mean? Well, this movement has received a lot of hate and trolls on this thread. Twitter profile declared:

“He fudded ETH with his first tweet, to hopefully drive the price down, and has since rebought eth lower.”

Create a FUD first (to hopefully lower the price) and then buy it back for a lower price? Is this a new strategy here?