Last week was quite eventful but perhaps what the crypto community was most excited about was the APE coin launch.

To recap, APE coin is the native cryptocurrency that underpins the Bored Ape Yacht Club ecosystem, and it was launched on March 17 and air-dropped to BAYC-linked NFT holders. The coin has seen billions of dollars in volume hitting some of the major exchanges.

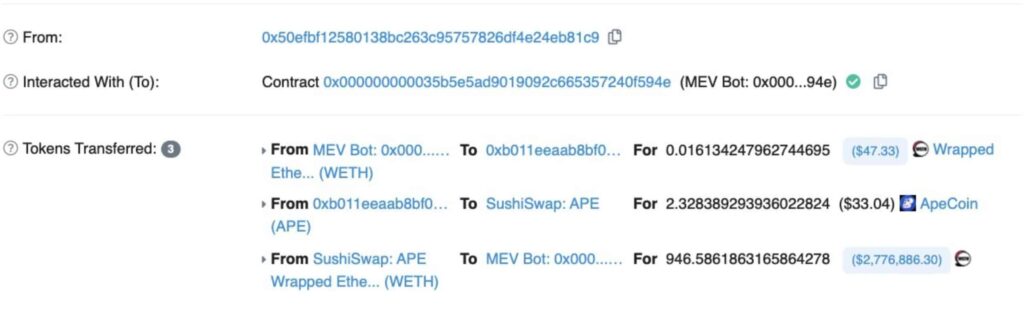

Amid all this, one particular transaction stood out and caught the attention of many. Let’s have a closer look at what really went down when a bot seemingly sold 2.4 APE for 946 ETH, worth $2.7 million at the time.

The Viral APE Transaction

Unpacking the whole situation was the well-known crypto proponent and former Coinbase engineer going through the 0xbeans.eth Twitter account.

This is what the transaction in question looks like:

The expert talks about the three transactions that are relevant to understanding what really happened and how no one really sold 2.4 APEs for nearly $3 million. What happened is the so-called “sandwich attack”.

This is possible entirely thanks to how automated market makers such as Uniswap and Sushiswap work.

What is a sandwich attack?

First of all, when someone sends a transaction to the Ethereum network, it is not executed and immediately included in a block. Instead, it arrives in a mempool and waits for a miner to pick it up. How miners choose which transactions to include is usually based on gas fees – the higher the higher the priority a transaction will have.

Another thing to consider is slippage. When setting slippage on a DEX like Uniswap, you’re basically telling the protocol that you are willing to pay a higher price (to a certain extent) by the time your transaction gets executed.

For example, if you want to buy 10 APE tokens for 100 ETH and you set a slippage of 2%, you are saying that you are willing to pay a maximum of 102 ETH for 10 APE tokens at the time your trade is executed (in case where there would be an increase).

This is where miner extractable value (MEV) bots come into place. They are set up to hunt transactions of the kind and front-run them by bidding the price up to the increased amount (following the above example – by 2%), squeezing the primary transaction between two others – one that buys a huge number of tokens to increase the price by 2 % and one that sells them at a higher price, essentially sandwiching the initial transaction – hence, the name.

What really happened in the APE transaction?

The transaction in question involves someone trying to exchange 1.5 ETH for APE tokens. However, we can also see that there is a bot that submitted two more transactions before and after the first one and sandwiched it.

The first transaction bought APE for roughly 4.13 ETH, and then the original transaction was executed, facing slippage. After that, the last transaction sold the APE it bought for 4.45 ETH, banking some 0.3 ETH profit in a single block.