The 2022 bear market has been brutal as more than $2 trillion in value has been wiped away from the crypto economy. In addition to record values lost, the crypto winter has managed to break a number of popular bitcoin price models like the rainbow price chart and Plan B’s infamous stock-to-flow model. Moreover, since May 11, 2022, the well known power-law corridor model or logarithmic growth curves chart has also broken, and it’s deviated below the lower band for roughly 86 days.

Deviation from the Norm: The 2022 Bitcoin Bear Market Breaks Some of the Most Popular Price Models

For many years, crypto traders have taken advantage of tools, charts and models to predict the future value of Bitcoin (BTC) and other popular digital assets. Bitcoin.com News has written about Plan B’s stock-to-flow (S2F) price model on several occasions, and the S2F model in 2021 was fairly accurate until the end of November.

Additionally, many bitcoiners count on other charts and price models like the golden ratio multiplier, the Fibonacci sequence, the rainbow model, and logarithmic growth curves. During the last quarter of 2021, bitcoin traders expected BTC to reach $100K per coin by the year’s end.

In September 2021, when BTC was swapping for prices between $45K and $50K, Will Clemente, principal insight analyst at Blockware Solutions, tweeted about a new price model he called the “illiquid supply floor”. Told. At the time, Clemente said that the model combined Glassnode’s illiquid supply data with Plan B’s S2F model, adding that it created a bitcoin floor price based on real-time scarcity of BTC.

The floor value Clemente predicted was $39K and as time passed the analyst’s Illiquid Supply Floor model broke. Even after Plan B’s S2F “worst-case scenario” prediction deviated at the end of November, the pseudonymous analyst said he was confident that bitcoin’s price was still “on track towards $100K.”

None of these bold predictions came to fruition, and in the midst of the start of the crypto bear market, this was the type of price model. openly mocked And condemned by many in the crypto community. The illiquid supply floor was not solid, S2F broke down, and people made fun of the popular “rainbow” price indicator.

The Popular Power-Law Corridor Model Has Logged an 86 Consecutive Day Break From the Norm

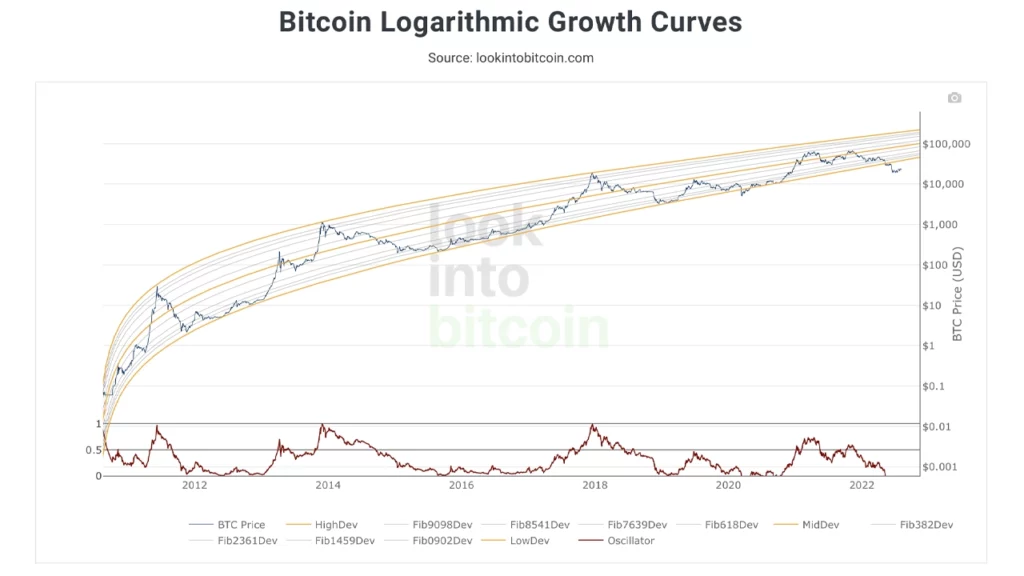

Furthermore, one of the most popular bitcoin price models, known as the power-law corridor model, or logarithmic growth curves chart, has also been broken since May 11, 2022. The chart is favored because BTC’s price timeline can be seen from a logarithmic perspective. In fact, a log price chart is one of the most popular in the world of crypto and traditional financial technical analysis.

Bitcoin logarithmic growth curve charts are hosted on crypto web portals such as lookintobitcoin.com and coinglass.com. The current divergence is unusual as the price of BTC has only broken below the lower band twice in its history prior to 2022. The first divergence was an accelerated event in October 2010, and the second most notable divergence occurred on March 11, 2020.

March 11, 2020, otherwise known as ‘Black Thursday,’ was an interesting day for every asset on planet earth as financial markets shuddered across the board. At that time, BTC broke beneath the $4K range, and the move sunk below the low dev line on the logarithmic growth curves chart.

This specific event did not last very long as global markets rebounded from the initial COVID-19 scare, and a bull market followed almost immediately. The price of bitcoin skyrocketed to the $64K area in April 2021, and above that range to $69K on November 10, 2021.

Nine months later, bitcoin’s (BTC) price is down 66% below the $69K all-time high, and the popular and often reliable logarithmic growth curves model has been broken for 86 consecutive days. While BTC has seen the first bear market rally, the price still has a ways to go to get back into the power-law corridor’s lower band.

Price Right now For this to happen, the price must be just above the $35K range. The price of bitcoin has never broken below the low band line for so long, and this is unusual given BTC’s 13-year price cycle. The break shows that markets often follow specific mathematical laws, patterns and models, but these types of technical methods are not always accurate.

Currently, the latest bear market rally and other factors indicate that it’s quite possible the bottom is in for this specific crypto winter, but as charts and signals like these have broken in the past, it means no one can truly guarantee the crypto market bottom is in.