Event previously considered as bearish might become growth fuel for market

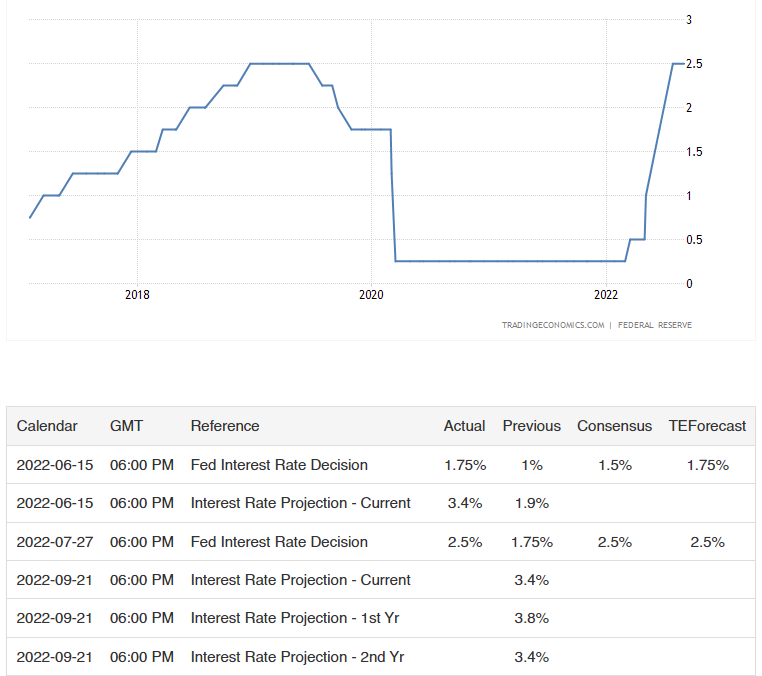

The upcoming FOMC meeting has always been a tense event for both the cryptocurrency and the stock market as regulators tune in to the country’s monetary policy by increasing or reduction in the prime rate. However, some industry experts are expecting a short-term relief rally.

Market’s predictability

According to the structure of S&P500 options, we might see a post-FOMC one-day “wonder” rally when the market’s expectations match the Fed’s decision, despite its negative or positive nature.

We saw a similar rally during the last FOMC meeting, when the price of bitcoin was up more than 14%, with an expected 75 bp increase. It had no positive effect on riskier assets like bitcoin or cryptocurrencies.

The market’s consensus today is another 75 bp rate hike, which will certainly cause another short-term rally. However, the possibility of a more significant 100 bp hike has increased largely after the unexpectedly high inflation numbers in the most recent CPI report.

If the Fed, for whatever reason, decides that a 75bp move is not enough to control rising inflation, the market will move by 100bp. Such an increase will certainly cause unrest among cryptocurrency holders as it obscures the future of the industry and negates the possibility of a market correction by mid or late 2023.

Crypto is in depressing state

The Ethereum Merge update has been the main driver for the market for the last few weeks and even months. With the successful implementation of the upgrade on Ethereum, most assets that benefited from it plunged massively.

Alternative networks that inherit Ethereum’s hash rate are also in bad shape as investors are not seeing the same growth potential as Ethereum in them.